Starting a new business venture is an exhilarating journey filled with opportunities and challenges. While you may be fueled by passion and a great business idea, it’s important to remember that a solid financial foundation is crucial for the success of your startup. One of the key steps in financial planning is creating a business budget. In this guide, we’ll walk you through the process of crafting a budget that will help you manage your finances, make informed decisions, and pave the way for your startup’s growth.

Why Is a Business Budget Essential for Startups?

Before we dive into the nitty-gritty of creating a budget, let’s explore why it’s so essential for startups:

- Financial Control: A budget gives you control over your finances by providing a clear understanding of your income and expenses. It’s a tool to help you manage your cash flow efficiently.

- Planning and Forecasting: Budgets enable you to set financial goals and forecast your future financial health. This allows you to plan for growth, anticipate challenges, and make informed decisions.

- Resource Allocation: With a budget, you can allocate resources where they are needed most. This helps you prioritize spending on activities that will drive your startup’s success.

- Investor Attraction: If you’re seeking investment or loans, potential investors and lenders will want to see a well-structured budget to evaluate your financial viability.

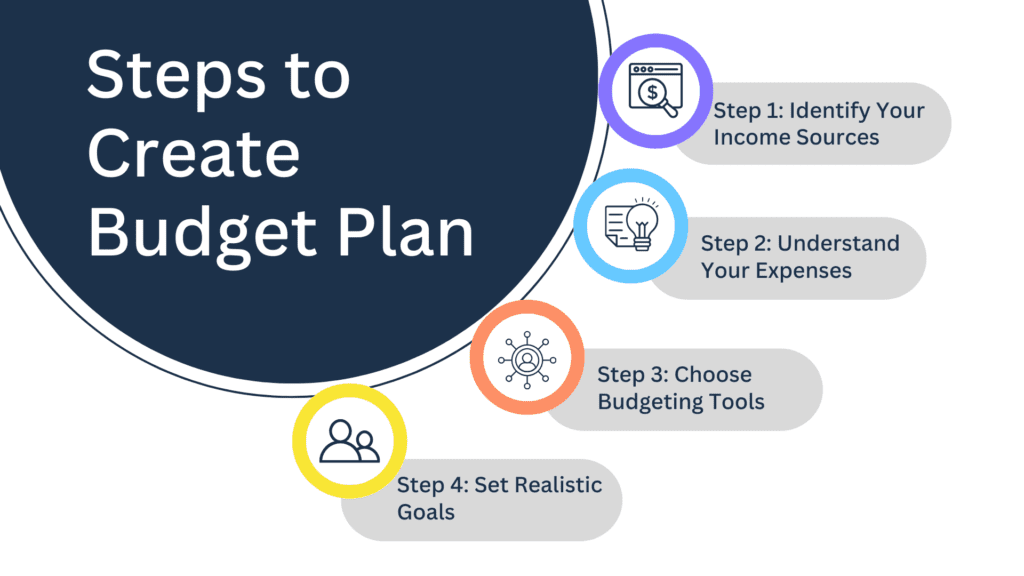

Now that you understand why a budget is crucial, let’s go through the steps to create budget plan for your startup:

Step 1: Identify Your Income Sources

The first step in creating a budget is to identify all your income sources. For a startup, this typically includes:

- Sales Revenue: Estimate your monthly sales revenue based on your pricing strategy, market research, and sales projections.

- Investment or Capital Infusion: If you’re starting with initial investment capital or loans, make sure to include this in your income.

- Other Sources: Consider any additional income sources specific to your business, such as interest income, royalties, or consulting fees.

Step 2: Understand Your Expenses

Next, you need to detail your monthly expenses. Start with the essentials:

- Fixed Costs: These are expenses that remain relatively constant, like rent, utilities, insurance, and salaries.

- Variable Costs: Variable costs can change month-to-month based on your business activities. They include things like materials, marketing, and travel expenses.

- One-Time Costs: Consider any one-time or occasional expenses, like equipment purchases or website development.

Step 3: Choose Budgeting Tools and Software

To streamline the budgeting process, consider using budgeting tools and software. These can help you organize your financial data and create accurate projections. Some popular options include:

- Microsoft Excel: A versatile and widely used spreadsheet software that allows you to create customized budget templates.

- QuickBooks: A comprehensive accounting software that includes budgeting features.

- Online Budgeting Tools: There are various online tools and apps designed specifically for budgeting and financial planning.

Step 4: Set Realistic Goals

Now that you’ve listed your income sources and expenses, it’s time to set realistic financial goals. These goals will guide your budget and help you allocate resources efficiently. Consider both short-term and long-term goals, such as achieving a certain level of revenue by the end of the year or staying within budget for the next quarter.

Step 5: Track and Monitor Your Budget

Creating a budget is only the beginning. To benefit from it, you need to regularly track and monitor your financial performance. Review your budget against your actual income and expenses periodically, such as monthly or quarterly.

- Analyze Variances: Identify any discrepancies between your budgeted and actual figures. This will help you understand where you’re doing well and where adjustments are needed.

- Adapt as Needed: If you notice that certain expenses are consistently over budget or that your income projections were too optimistic, be prepared to adapt your budget accordingly.

- Stay Disciplined: Remember, a budget is a tool for financial discipline. Use it to make informed decisions and ensure you stay on track toward your financial goals.

In conclusion, creating a business budget is a fundamental step for every startup. It provides you with financial control, enables you to plan and forecast, and helps you allocate resources efficiently. By setting realistic goals, using budgeting tools, and consistently tracking your budget, you’ll be well-prepared to navigate the financial challenges that come your way and set your startup on the path to success.